As investors, one of the most critical factors to monitor in today’s market is the movement of interest rates. These fluctuations don’t just influence your borrowing power—they shape everything from property prices to rental returns and, ultimately, your investment outcomes. At Brisbane Buyers’ Agency, we work exclusively for buyers, helping you understand how these changes affect yield potential across Brisbane’s inner-ring suburbs.

Led by our director, Paul Palella, we’ve seen firsthand how rate shifts have impacted the market—and where opportunities are emerging as a result.

From Rising Costs to Renewed Confidence: A Changing Investor Landscape

Throughout 2024 and into early 2025, rising interest rates led to significant increases in mortgage repayments. This inevitably dampened investor sentiment across Brisbane, particularly in premium inner suburbs such as Paddington, West End, and Teneriffe. While Brisbane’s relative affordability and steady population growth initially softened the blow, a clear decline in investor activity followed.

However, the tide began to turn in early 2025. With the Reserve Bank of Australia cutting interest rates, the cost of funding has eased—restoring confidence among buyers and revitalising demand, especially in well-located, high-demand areas. We’re now seeing savvy investors re-entering the market, positioning themselves strategically ahead of further value growth.

Tight Vacancy + Soaring Rents = Strong Rental Pressure

If you’re considering an investment in Brisbane, the rental landscape deserves your attention. Vacancy rates in inner-city suburbs remain critically low—well below 1%—while rental prices have surged. Over the past decade, Brisbane has seen rents rise by more than 66%, with recent annual increases topping 34%.

Nationally, capital city rents have jumped by around $11,000 per year since 2020. Brisbane alone has outpaced that figure, with annual increases closer to $13,000. This upward pressure on rents—driven by low supply and strong demand—is placing investors in a favourable position, particularly those holding well-located inner-city units.

How Yields Compare Across Brisbane’s Market

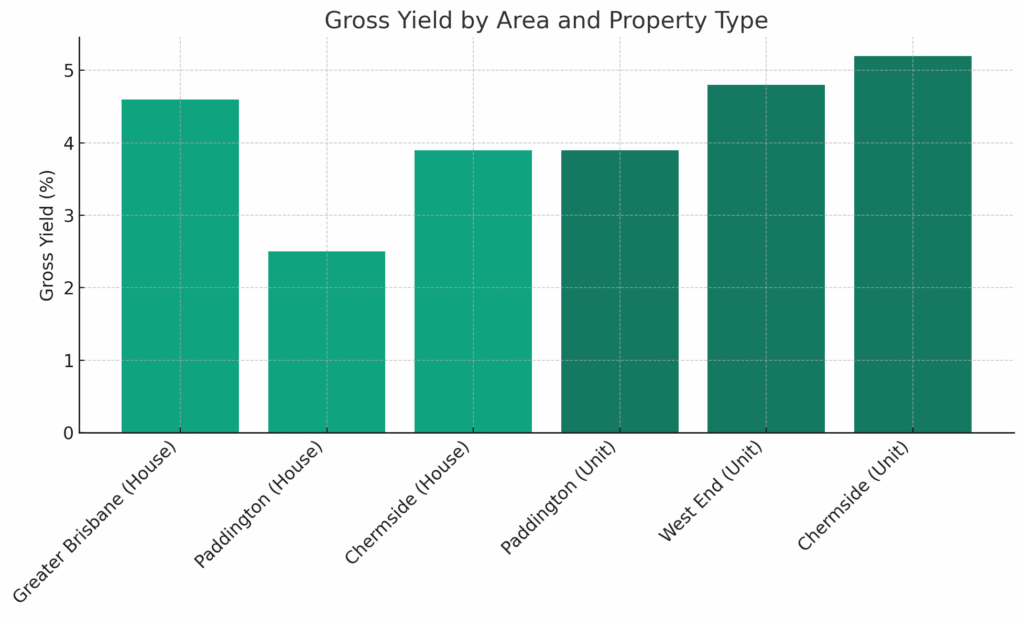

To truly understand the investment climate, let’s look at how yields are stacking up across key Brisbane locations:

Gross yield in % growth in house v/s units

What this tells us is that while house yields in blue-chip suburbs like Paddington sit lower due to premium pricing, unit investments—especially in areas like West End—are still delivering excellent returns. At the same time, outer-ring suburbs such as Chermside provide strong yields and more affordable entry points.

The key takeaway? There’s no one-size-fits-all approach. The best strategy depends on your investment goals and appetite for long-term capital growth versus short-term cash flow.

Yield Resilience in a Shifting Market

As interest rates climbed last year, we saw a softening in capital values. This, in turn, improved gross yields on paper, even if rental growth had plateaued in some areas. However, the reality is that rising mortgage costs still eroded net yields for many investors.

Fast forward to mid-2025, and we’re entering a new phase. As rates ease, borrowing becomes more affordable, and property values are rebounding—particularly in Brisbane’s tightly held inner suburbs. While this could lead to a slight compression in gross yields, strong rental growth and lower holding costs are sustaining healthy net returns, especially for units positioned in high-demand pockets.

Where Are Investors Looking Now?

We’re seeing a clear bifurcation in the market. Investors with a long-term view are continuing to favour inner-city units due to their reliable rental demand and proximity to employment, education, and lifestyle hubs. With entry prices starting from the mid-$500,000s and yields ranging from 4.6% to 5%, properties in West End and surrounding areas remain attractive.

Meanwhile, others are turning to middle-ring suburbs like Chermside and Logan Central to capitalise on stronger yields—often exceeding 5%—and a more affordable investment threshold.

We work with you to identify which strategy best aligns with your portfolio goals. Whether you’re seeking high cash flow or strong capital growth, we tailor every Buying Brief to ensure the numbers stack up from day one.

Why Use a Buyers Agent? http://bit.ly/4onymfN

What This Means for You as an Investor

Understanding where we are in the interest rate cycle—and what’s ahead—can be the difference between a reactive investment and a strategic one.

- When rates fall, capital values in inner suburbs typically rise. But if you’ve secured your property before the upswing, you benefit from both capital gains and rental growth.

- Units in particular are proving resilient, offering stronger returns and consistent demand across both inner and outer suburbs.

- Houses, while commanding lower yields in prestige suburbs, continue to deliver long-term capital growth—especially in locations undergoing major infrastructure upgrades, such as the Cross River Rail corridor.

Final Thoughts: Investing with Purpose

Shifting interest rate conditions can feel like a challenge—but for the informed investor, they present opportunity.

If you’re looking to enter the Brisbane property market or expand your existing portfolio, now is the time to act. With borrowing costs easing, rental prices holding firm, and buyer sentiment improving, Brisbane’s inner-city unit market is once again in the spotlight. The key is knowing where—and when—to invest.

At Brisbane Buyers’ Agency, we’re here to guide you every step of the way. Our buyer-only model ensures that your best interests are front and centre. Backed by local expertise, strategic insights, and the leadership of director Paul Palella, we’ll help you navigate the market with confidence.

Best suburbs for rental benefit in Brisbane: Chermside and Logan Central

Book Your Free Insight Session Today

Take the next step toward smarter investing. Book a complimentary strategy session with Paul Palella to:

✔ Create your tailored Buying Brief

✔ Understand current market movements and opportunities

✔ Explore high-yield and growth suburbs based on your goals

Click the link to explore our Services for Property Investors — to reinforce insights on investor strategies : Property Investor Services

You can also call Paul directly on 0409 499 034 or email paul@brisbanebuyersagency.com.au to arrange your session. Your next great investment move starts here.